Current bond price formula

Annual coupon payment Current market price 100 950 1053 Scenario 2. It sums the present value of the bonds future cash flows to provide price.

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Price Cash flow t 1YTM t The formula for a bonds current yield can be derived by using the following steps.

. ASCII characters only characters found on a standard US keyboard. Bond price is calculated as the present value of the cash flow generated by the bond namely the coupon payment throughout the life of the bond and the principal payment or the balloon payment at the end of the bonds lifeYou can see how it changes over time in the bond price chart in our calculator. Ian Fleming created the fictional character of James Bond as the central figure for his works.

Mathematically the formula for coupon bond is represented as. Read more is basically. If the required rate of returns is 17 the value of the bond.

If the market price of the bond is 200 the current yield equals 40200 02 or 20 when expressed as a percentage. Next figure out the current market price of the bond. A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments.

You take this value and put it within the formula to get your current yield. The bond has a six year maturity value and has a premium of 10. In other terms say if Apples earnings and share price remain stable at the current level it needs any investor 139 years to recover the share price paid today.

Subtotal 3000 30. Shipping cost delivery date and order total including tax shown at checkout. Bond price when yield increases by 1 Price-1.

Reasons to calculate current yield. This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as a yield to price calculator. 50 out of 5 stars My hair is so soft.

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the assets price. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Firstly determine the potential coupon payment to be generated in the next one year.

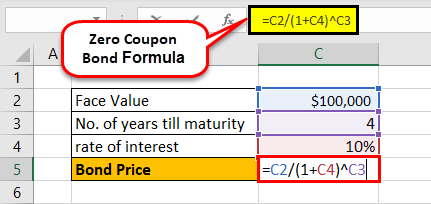

To use bond price equation you need to input the following. With our money back guarantee our customers have the right to request and. Zero-Coupon Bond Yield-to-Maturity YTM Formula.

Price Elasticity of Demand 045 Explanation of the Price Elasticity formula. The yield-to-maturity YTM is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. Current Yield of Bond Formula.

Every sweet feature you might think of is already included in the price so there will be no unpleasant surprises at the checkout. CBS News Bay Area. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows which include coupon payments and the par value which is the redemption amount at maturity.

Explanation of Current Ratio Formula. Subtotal 1295 12. Find present value of the bond when par value or face value is Rs.

Bond valuation strategies are further illustrated to clarify bond valuation. 6 to 30 characters long. The formula below calculates the interest rate that sets the present value PV of a bonds scheduled coupon payments and the call price equal to the current bond price.

In the context of zero-coupon bonds the YTM is the discount rate r that sets the present value PV of the bonds cash flows equal to the current market price. Sign doesnt matter But stick with the better convexity formula if you have time to calculate it or come back and visit this page. This occurs when a bonds coupon rate surpasses its prevailing market rate of interest.

It returns a clean price and dirty price market price. Buy Young Nails Protein Bond. The term bond formula refers to the bond price determination technique that involves computation of present value PV of all probable future cash flows such as coupon payments and par or face value at maturity.

N Number of Periods Until. YTM interest rate or required yield P Par Value of the bond Examples of Bond Pricing Formula With Excel Template Lets take an example to understand the calculation of Bond Pricing in a better manner. Must contain at least 4 different symbols.

The PV is calculated by discounting the cash flow using yield to maturity YTM. It gives an idea to the investor whether a company has the ability to generate enough cash to pay back its short-term liabilities. This lets us find the most appropriate writer for any type of assignment.

You can contact us any time of day and night with any questions. Bond price when yield decreases by 1 Price. The current ratio measures liquidityworking capital management of the company.

Analyzing a bond or other fixed securitys current yield can inform you of how profitable a business investment. Percentage point change in yield note that its squared. N Period which takes values from 0 to the nth period till the cash flows ending period C n Coupon payment in the nth period.

Well always be happy to help you out. Bond is an intelligence officer in the Secret Intelligence Service commonly known as MI6Bond is known by his code number 007 and was a Royal Naval Reserve CommanderFleming based his fictional creation on a number of individuals he came across during his time in the Naval. The yield to maturity YTM refers to the rate of interest used to discount future cash flows.

100 coupon rate is 15 current market price is Rs. One person found this helpful. The higher the ratio the more current assets a company has compared to its liabilities.

A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan. R Yield to Call. 00 x 30.

Earnings Per Share Formula. Breaking down PE Ratio Formula PE itself does not have much relevance in isolation but needs to be compared across timecompanies to make informed decisions. Simple Interest Rate Formula.

The bottle is small and said to be small to make sure theyre formula is great. 95 x 12. Nail Prep Fast Drying.

Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. The law of demand states that as the price of the commodity or the product increases the demand for that product or the commodity will eventually decrease all conditions being equal. Price Elasticity of Demand 4385 98.

Formula to Calculate Bond Price. Cash Flow from Operations Formula. This bond shampoo has given my hair great strength.

Breaking Local News First Alert Weather Community Journalism. Current trading price Δyield. Initial Bond Price PV C 1 1 1 r n r Call Price 1 r n.

Here we discuss how to calculate Mode Formula along with practical examples Calculator and excel template.

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Bond Pricing Formula How To Calculate Bond Price Examples

An Introduction To Bonds Bond Valuation Bond Pricing

Excel Formula Bond Valuation Example Exceljet

Bond Price Formula Excelchat Excelchat

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Calculator

Bond Pricing Formula How To Calculate Bond Price Examples

Zero Coupon Bond Formula And Calculator

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Pv Of A Different Bond Type With Excel

How To Calculate Bond Price In Excel

Yield To Call Ytc Bond Formula And Calculator

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate The Current Price Of A Bond Youtube